All Categories

Featured

Table of Contents

The technique has its own advantages, however it also has issues with high charges, intricacy, and more, causing it being pertained to as a scam by some. Unlimited financial is not the ideal plan if you require only the investment element. The infinite banking principle rotates around making use of entire life insurance policies as a monetary tool.

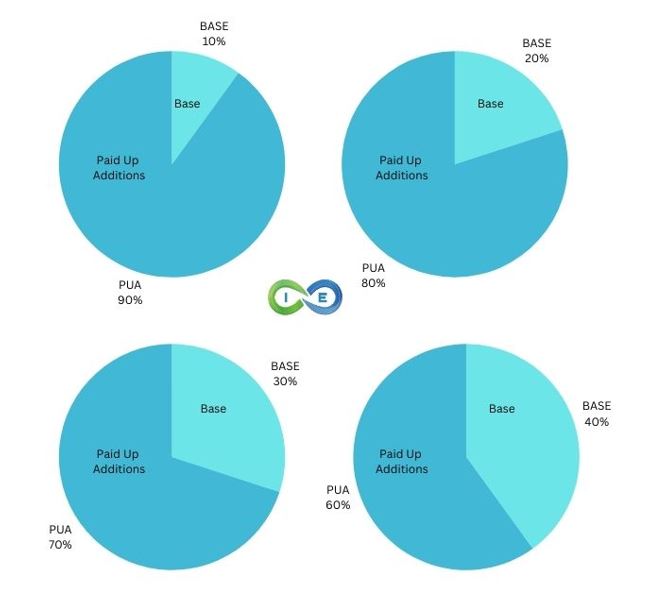

A PUAR enables you to "overfund" your insurance coverage policy right up to line of it ending up being a Customized Endowment Contract (MEC). When you make use of a PUAR, you rapidly enhance your cash money value (and your fatality advantage), therefore increasing the power of your "bank". Better, the even more money value you have, the greater your interest and returns payments from your insurance policy company will be.

With the surge of TikTok as an information-sharing platform, economic guidance and methods have discovered an unique means of dispersing. One such method that has been making the rounds is the unlimited banking concept, or IBC for short, garnering recommendations from celebrities like rapper Waka Flocka Fire - Private banking strategies. While the method is currently preferred, its origins map back to the 1980s when financial expert Nelson Nash presented it to the world.

What happens if I stop using Policy Loan Strategy?

Within these policies, the cash value expands based upon a rate set by the insurance firm. Once a substantial money worth accumulates, policyholders can obtain a money value lending. These fundings differ from traditional ones, with life insurance acting as security, implying one might shed their insurance coverage if loaning exceedingly without sufficient cash value to sustain the insurance policy expenses.

And while the attraction of these plans is apparent, there are natural constraints and risks, demanding attentive money worth surveillance. The technique's authenticity isn't black and white. For high-net-worth people or entrepreneur, particularly those making use of techniques like company-owned life insurance policy (COLI), the advantages of tax breaks and substance development could be appealing.

The attraction of boundless banking does not negate its obstacles: Expense: The foundational need, a long-term life insurance coverage plan, is costlier than its term equivalents. Eligibility: Not everyone qualifies for entire life insurance policy because of strenuous underwriting processes that can leave out those with specific wellness or way of life problems. Intricacy and danger: The detailed nature of IBC, combined with its threats, may prevent many, particularly when simpler and much less high-risk options are available.

How can Privatized Banking System reduce my reliance on banks?

Assigning around 10% of your regular monthly income to the plan is just not feasible for the majority of individuals. Part of what you read below is merely a reiteration of what has actually currently been claimed over.

Before you obtain on your own into a scenario you're not prepared for, recognize the adhering to initially: Although the principle is generally marketed as such, you're not really taking a financing from yourself. If that held true, you wouldn't have to settle it. Rather, you're obtaining from the insurance policy firm and have to settle it with passion.

Some social media sites blog posts suggest making use of money worth from whole life insurance policy to pay for bank card debt. The concept is that when you pay back the loan with interest, the amount will be sent out back to your financial investments. That's not exactly how it functions. When you pay back the financing, a section of that interest goes to the insurer.

How do I qualify for Financial Independence Through Infinite Banking?

For the first numerous years, you'll be paying off the commission. This makes it incredibly challenging for your plan to gather value during this time. Whole life insurance coverage costs 5 to 15 times extra than term insurance coverage. Lots of people just can't manage it. Unless you can afford to pay a couple of to several hundred dollars for the next decade or even more, IBC won't work for you.

Infinite Banking is not just for entrepreneurs—it’s a powerful tool for families.

Parents can use Infinite Banking to create a financial safety net, all while ensuring long-term wealth growth.

Legacy planning experts assist in ensuring maximum benefits for family security - how infinite banking can help entrepreneurs. Discover how Infinite Banking can build your family’s legacy to set up a tax-free financial system

Not everyone ought to depend solely on themselves for economic security. Financial leverage with Infinite Banking. If you need life insurance coverage, here are some useful ideas to consider: Take into consideration term life insurance policy. These policies supply insurance coverage throughout years with significant monetary commitments, like home mortgages, student lendings, or when caring for young youngsters. Ensure to look around for the very best rate.

What happens if I stop using Infinite Wealth Strategy?

Picture never having to stress concerning bank car loans or high rate of interest prices again. That's the power of boundless financial life insurance coverage.

There's no set car loan term, and you have the freedom to pick the settlement schedule, which can be as leisurely as repaying the lending at the time of fatality. This adaptability reaches the servicing of the financings, where you can select interest-only repayments, maintaining the lending balance flat and workable.

What is Cash Value Leveraging?

Holding cash in an IUL fixed account being attributed rate of interest can often be much better than holding the money on down payment at a bank.: You've always imagined opening your very own pastry shop. You can obtain from your IUL policy to cover the preliminary costs of renting an area, purchasing equipment, and hiring team.

Personal car loans can be gotten from standard financial institutions and credit score unions. Right here are some vital points to think about. Charge card can offer an adaptable way to borrow cash for extremely temporary durations. Borrowing cash on a credit card is generally really expensive with yearly percentage prices of passion (APR) commonly reaching 20% to 30% or even more a year.

Table of Contents

Latest Posts

Infinite Banking Nash

How Do I Start My Own Bank?

Generation Bank: Front Page

More

Latest Posts

Infinite Banking Nash

How Do I Start My Own Bank?

Generation Bank: Front Page